AI-Fueled iPhone Sales Drop During World’s Biggest Shopping Holiday In China

The strength of the Apple iPhone 16 upgrade cycle has been one of the most critical questions for Wall Street analysts tracking the handset market. Apple’s latest earnings reveal that the highly anticipated AI-driven upgrade supercycle this fall has largely fallen short, compounded by new data from a research firm indicating underwhelming demand in the Chinese market.

Counterpoint Research published a new note on Wednesday showing that iPhone 16 sales during China’s Singles’ Day—the world’s largest holiday shopping period, spanning two weeks—bombed as consumers opted for domestic brands instead.

Here’s more color on the report via South China Morning Post:

The country’s two-week Singles’ Day sales period this year yielded “a double-digit, year-on-year decline in iPhone sales”, as Apple “faced pressure from an abnormally high number” of new flagship smartphone models that domestic competitors launched just before and during the annual shopping extravaganza, according to a report published on Wednesday by Counterpoint Research.

The report did not provide the exact percentage drop or the fewer number of iPhone sales that Counterpoint tracked during the event’s sales period, which ran from October 28 to November 10.

…

This year’s Singles’ Day debacle for Apple, which saw iPhone 16 prices slashed as part of online promotions, reflects the continued cutthroat competition in the world’s biggest smartphone market, where major Chinese handset vendors have already launched on-device artificial intelligence (AI) ahead of the US tech giant.

Overall, Singles’ Day smartphone sales this year fell 9 per cent compared with last year, as market demand and consumers’ enthusiasm for promotions have been subdued by economic headwinds, according to the Counterpoint report.-SCMP

Chinese smartphone brands, such as Vivo, Huawei, Xiaomi, Honor, and Oppo, are quickly taking market share away from Apple. Counterpoint’s report last month showed that Apple held the sixth spot with about 13.5% market share.

Apple’s much-awaited AI-led upgrade supercycle in the world’s largest handset market has been delayed primarily because Beijing still has to approve its AI services.

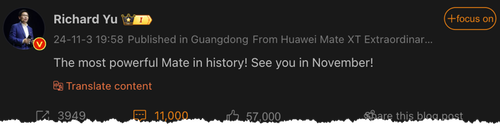

Meanwhile, competitor Huawei plans to launch the “most powerful” Mate Smartphone this month.

“The most powerful Mate in history! See you in November!” Huawei’s consumer group chairman, Richard Yu, wrote in a short post on Chinese social media platform Weibo.

Trade war fears with incoming President-elect Donald Trump have likely increased patriotic fervor in China to ditch Tim Cook’s products for domestic ones.

We have covered the dismal iPhone upgrade supercycle this fall:

-

No AI-Fueled Upgrade Supercycle? Apple iPhone 16 Discounts Offered At Major Chinese Online Retailers

-

Apple Slips On Pre-Order Analysis Showing Weak iPhone 16 Pro Demand

-

Apple’s iPhone 16 Sales Falling Short Of Expectations; DigiTimes Says

-

Barclays Analysts Find “Weak” iPhone 16 Demand After Supply Chain Check

The strength of the iPhone 16 cycle is indeed underwhelming. Oops, AI.

Tyler Durden

Thu, 11/21/2024 – 09:45